In the fascinating realm of cryptocurrency, few names carry as much weight as Satoshi Nakamoto, the mysterious figure behind the creation of Bitcoin.

I did a short video about it a few years ago:

Satoshi’s contributions revolutionized how we perceive and engage with (digital) currency, yet much about this enigmatic persona remains mysterious.

Among the many enigmas surrounding Satoshi, the allure of his lost emails captivates the imagination of crypto enthusiasts and historians alike.

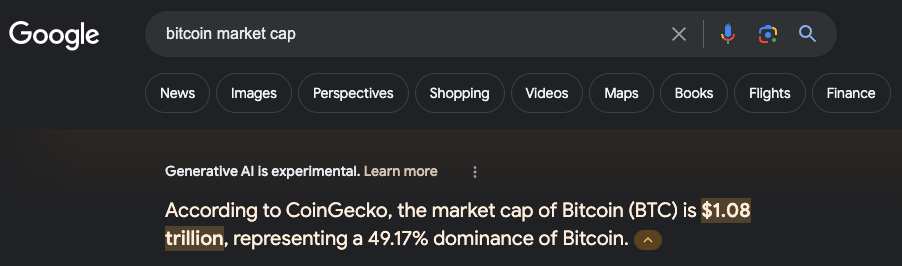

The story begins with Satoshi Nakamoto’s groundbreaking whitepaper, published in 2008, which laid the foundation for Bitcoin. By the way, it’s the best paper I read. In 9 pages, you can gain much wisdom and even understand this complex technical, game theory, and economic brilliance. These nine pages created around 1 trillion dollars of value as of today.

Following this seminal document, Satoshi engaged in correspondence with a select group of individuals, sharing insights, exchanging ideas, and offering guidance on this cryptocurrency project.

However, the intrigue deepened as Satoshi’s correspondence abruptly ceased in 2011, leaving a void of silence that has puzzled researchers and historians ever since. The reasons behind this cessation remain a subject of speculation, ranging from personal reasons to concerns about legal implications and privacy.

Despite the veil of mystery surrounding Satoshi’s disappearance from the digital realm, the significance of his lost emails cannot be overstated. These messages provide a rare glimpse into the mind of the visionary creator who sparked a global financial revolution. Within the digital archives lie clues to Satoshi’s thought processes, motivations, and challenges in birthing Bitcoin into existence.

Understanding the context of Satoshi’s emails is essential for several reasons. First and foremost, they offer a unique perspective on the early days of Bitcoin’s development, shedding light on the technical intricacies, philosophical underpinnings, and ideological debates that shaped its evolution. I was smiling when they mentioned ‘sourceforge’ as GitHub started to go public around 2008, and we are talking about 2009 here.

Satoshi’s lost emails are a cautionary tale about the ephemeral nature of digital communication. In an era where digital footprints are meticulously tracked and archived, the disappearance of Satoshi’s correspondence underscores the impermanence of online interactions. It reminds us of the importance of preserving digital artifacts for posterity, ensuring that future generations can study and learn from the pioneers who paved the way for technological innovation.

Luckly, we just got 120 pages of emails that were just released from the early Bitcoin days.

The emails are 14+ years old and were sent between:

- Martti Malmi who was an OG Bitcoin developer.

- Satoshi Nakomoto the creator of Bitcoin.

Here are some of the interesting questions that these emails are answering:

Continue reading